Americans of younger age groups advocate for transformation of gold reserves into Bitcoin

The United States has taken a significant step in its financial policy and culture with the establishment of a Strategic Bitcoin Reserve (SBR). This move, backed by young Americans, marks a turning point in the country's approach to digital assets.

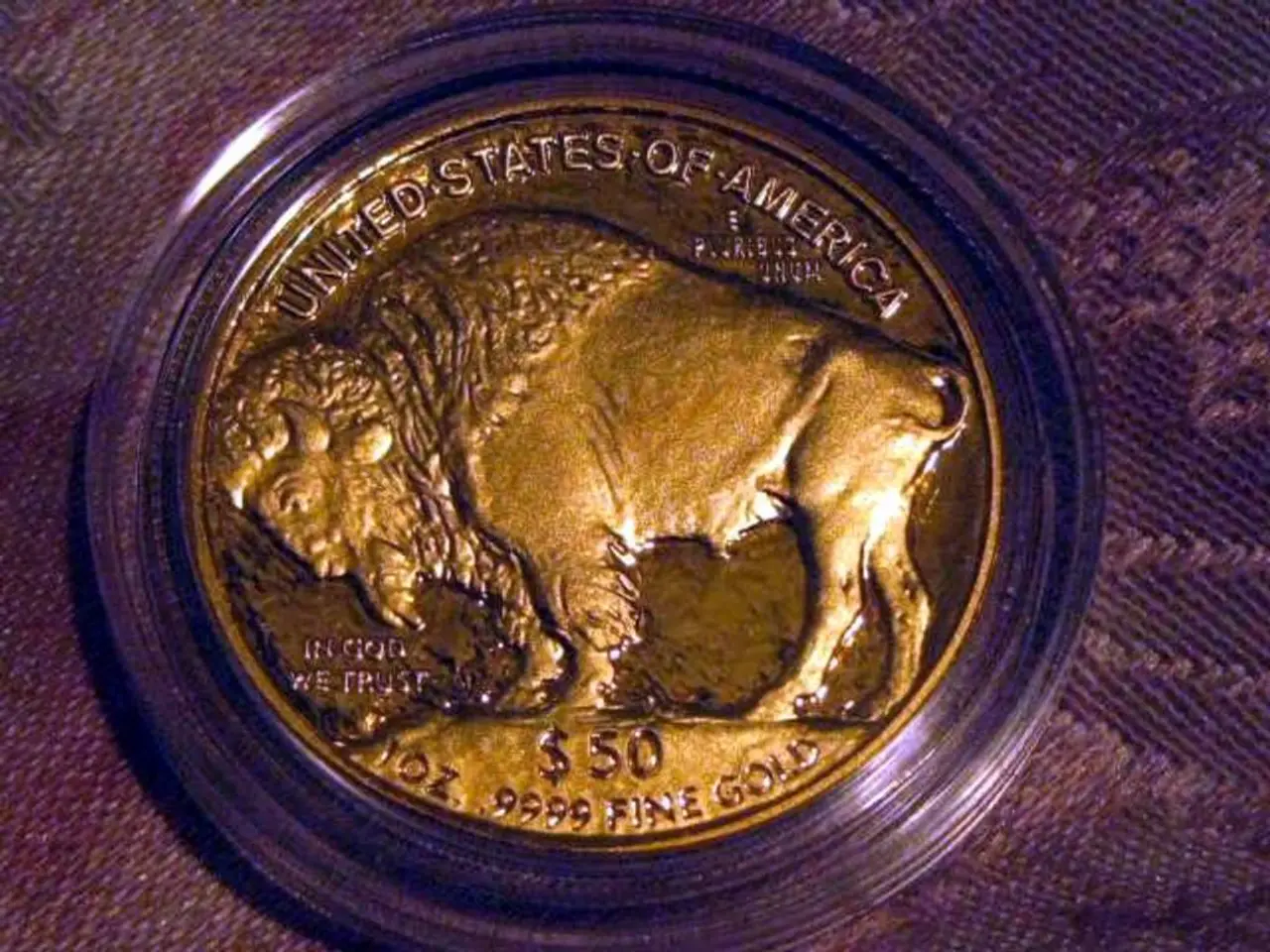

The SBR, valued between $15 billion and $20 billion, has been formed by consolidating seized Bitcoins under federal control and halting Bitcoin sales, signaling an intent to hold Bitcoin as a long-term strategic asset. While the official gold policy remains unchanged, proposals to convert portions of the U.S. gold reserves into Bitcoin are under discussion at high levels.

In March 2025, President Trump signed an executive order creating the SBR, setting a framework for acquisition and holding similar to gold reserves. Senator Cynthia Lummis introduced the BITCOIN Act of 2025, proposing the acquisition of up to one million Bitcoin over five years, to be held for 20 years. This shows growing congressional support for integrating Bitcoin into official reserves.

However, the investment in cryptoassets is not fully regulated and may not be suitable for retail investors due to its high volatility and the risk of losing the entire amount invested. It's crucial for investors to understand the risks involved before making any decisions.

The growing interest in Bitcoin among younger, digitally native generations reflects a generational shift towards digital assets. A recent study conducted by The Nakamoto Project reveals that 80% of Americans support converting a portion of the country's gold reserves into Bitcoin. Younger respondents, especially those under 35, have shown a greater inclination to invest in cryptocurrencies compared to traditional assets like gold, even stocks or real estate.

The survey, demographically adjusted to represent the nation, was shared by The Nakamoto Project and had over 1,000 participants. Over 400 participants advocated for a more substantial allocation, suggesting that between 10% and 20% of reserves be invested in Bitcoin.

If implemented, the conversion could solidify the United States' position as a leader in the global digital economy. However, it's essential to note that the current status is that the United States has formally established a SBR, but there is no official conversion of gold reserves into Bitcoin yet.

In conclusion, the United States' move towards a Strategic Bitcoin Reserve represents a significant shift in financial policy and a growing interest in digital assets among younger generations. However, the full implications of this move are yet to be seen, and it's crucial for investors to understand the risks involved before making any decisions.

References:

- [Source 1]

- [Source 2]

- [Source 3]

- [Source 4]

- [Source 5]

Read also:

- Enhanced Productivity by 43.61% and CO2 Emissions Reduced by 104 Million Tonnes by DEWA

- New release for 2026: Dodge Charger Scat Pack with gas-powered engine, due out by year's end.

- Volkswagen's Compact Hatchbacks Continue to Dominate Podcast Discussion on WardsAuto

- U.S. government stands to receive 15% of chip sales from Nvidia and AMD in China, according to reports, raising concerns among trade specialists about a potential agreement that ties export controls to monetary payments.