Centralized Shift for Solana: Removing 150 Validators - Revisiting Decentralization Concepts?

Hey there! Let's chat about Solana (SOL). The Solana Foundation is making a move to incentivize self-reliance and boost network decentralization by gradually withdrawing support for validators with insufficient external backing—approximately 150 validators are on the chopping block!

Mert Mumtaz, Helius Labs founder and Solana developer, announced the change in an X post on April 23rd, deeming it a bullish sign for the network. He said, "Solana Foundation is now gradually reducing the number of validators it delegates to incentivize nodes to be more self-reliant. Extremely bullish."

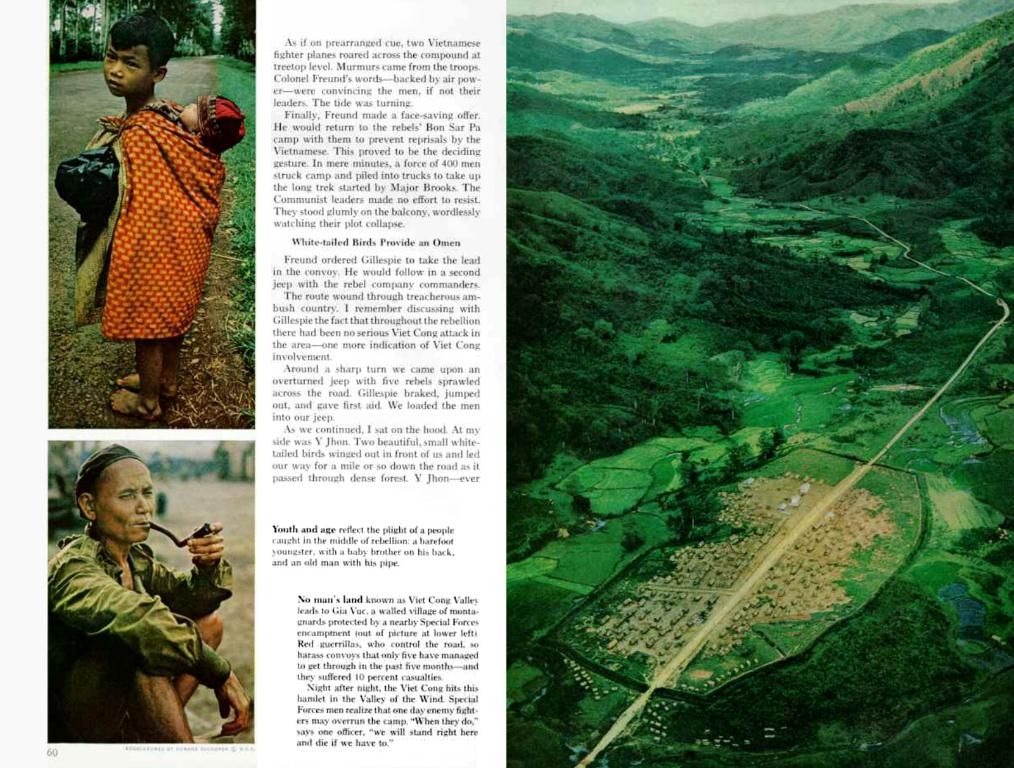

But, is this a bold bet on decentralization? Well, yes, and small operators might feel the heat. These nodes or validators stake SOL to propose blocks and safeguard network security. Cutting support for validators reliant solely on the Foundation's Delegated Program (SFDP) could affect their operations.

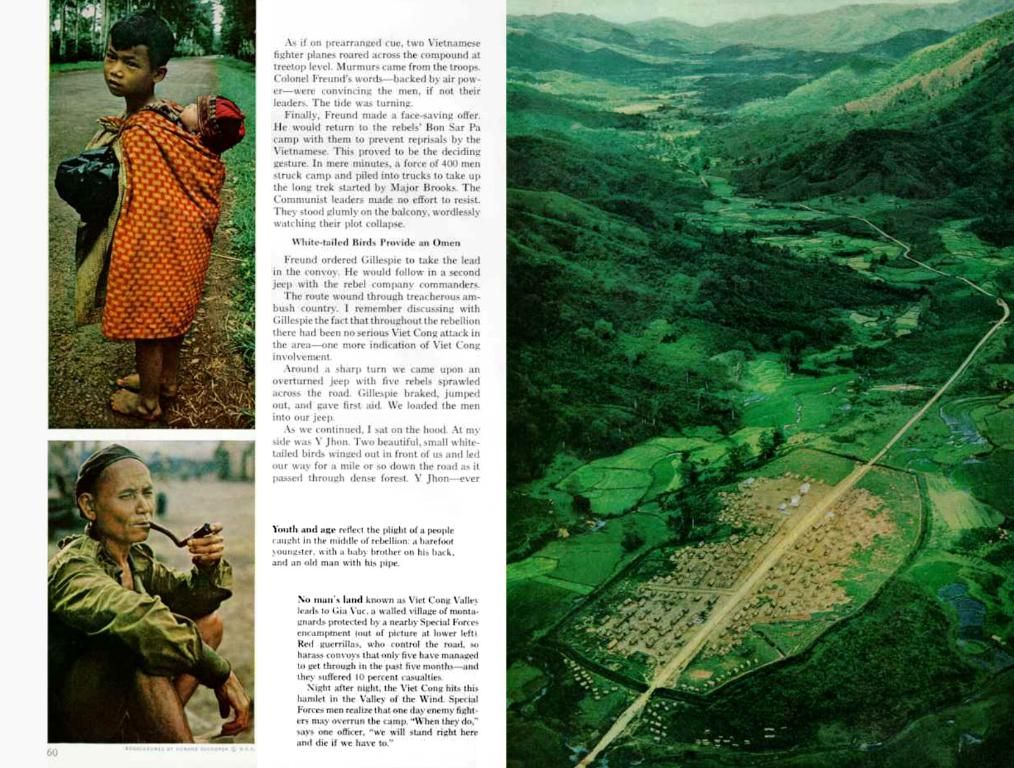

According to the research of Dan Smith, around 150 validators would be axed by this policy. The Foundation's delegate stake accounted for 20% of the total stake in 2022 (over 80 million SOL), but this has dropped to 40 million SOL, or about 10.5% of the total stake, as of 2025.

With approximately 1,224 active Solana validators currently in operation, totalling 389.4 million SOL tokens, about 900 of these validators are supported by the SFDP. However, the top validators don't rely on the Foundation. It's worth noting that the revenue for validator operators has dwindled from $15.9 million to $1.3 million between January and April, which may further strain small validators.

Last year, Helius Labs issued a warning stating that if the SFDP were to be discontinued immediately, around 897 participants, accounting for 57% of all Solana validators, would struggle to maintain profitable operations.

Overall market sentiment has been negative for the past two days, but the validator update hasn't shifted the tide. The SOL price might dip below $150 unless BTC soars toward $100K.

Despite the challenges, market indicators are still strong. The price action remains robust on Stochastic RSI and whale positioning, and the bulls need to reclaim the $150-$160 level to demonstrate greater strength.

This move marks a significant transition towards community-driven validation, but the key to success lies in balancing the removal of underperforming operators with the onboarding of new entrants. While decentralization metrics could improve, smaller validators could face existential challenges.

- The Solana Foundation is reducing support for validators with less than 1000 SOL stake, affecting around 150 validators, according to Dan Smith's research.

- Mert Mumtaz, a Solana developer, sees this move as bullish for the network, indicating a bold bet on decentralization.

- These validators stake SOL to propose blocks and secure the network, and cutting support for Foundation-reliant validators could impact their operations.

- As of 2025, the Foundation's delegate stake has dropped to about 10.5% of the total SOL stake, down from 20% in 2022.

- With approximately 1,224 active Solana validators currently in operation, about 900 are supported by the Solana Foundation Delegate Program (SFDP).

- Despite the negative market sentiment and the potential dip in SOL price below $150, market indicators such as Stochastic RSI and whale positioning still suggest strong price action.

- The success of this transition towards community-driven validation hinges on balancing the removal of underperforming operators with the onboarding of new entrants, as smaller validators could face existential challenges.