The surge in commerce for virtual goods stemming from the gaming industry

In the ever-evolving world of digital entertainment, the market for gaming assets has emerged as a significant player, generating billions in revenue and capturing the attention of investors worldwide.

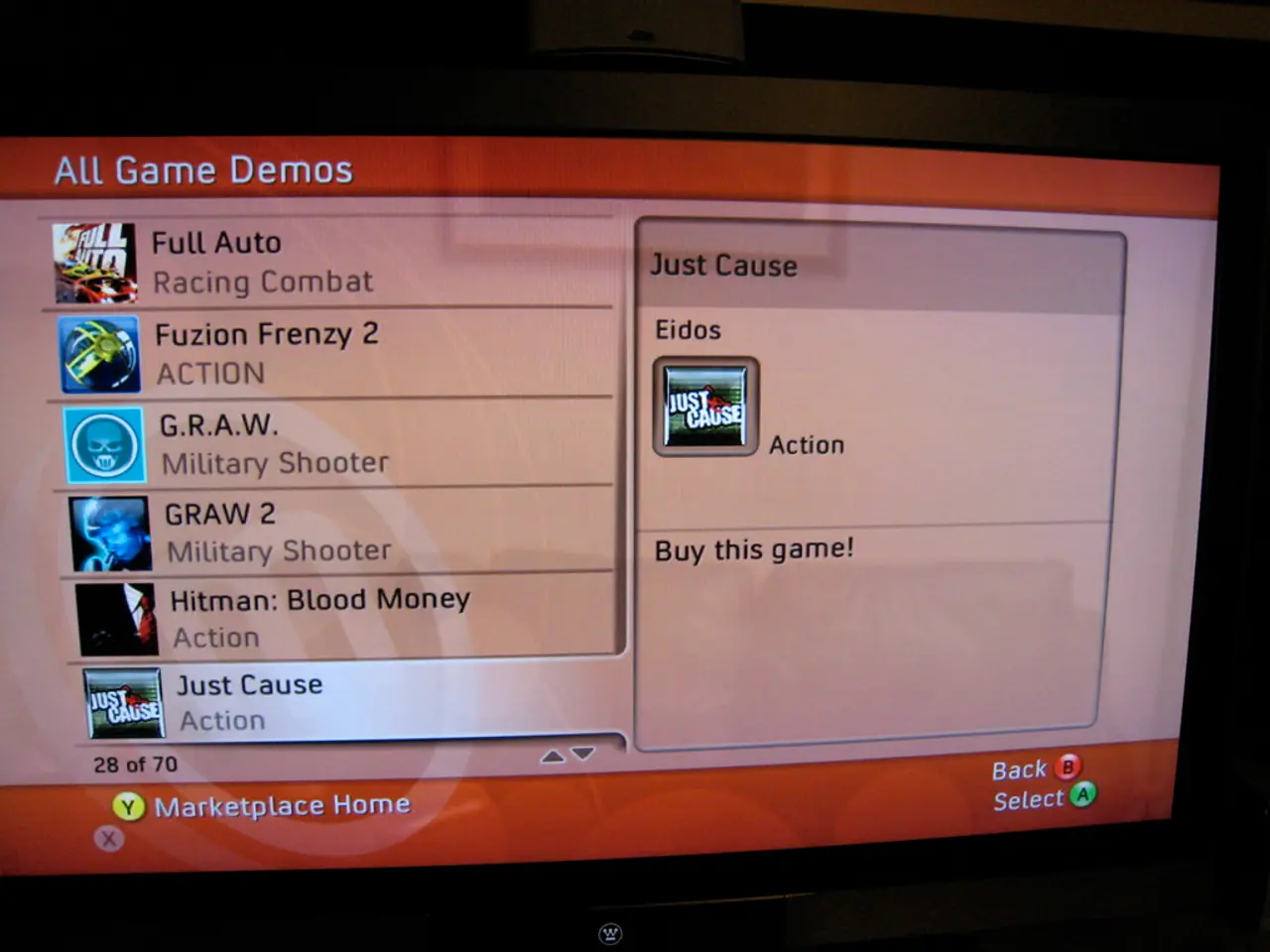

Digital gaming assets, such as animated gun finishes, rare outfits, trading cards, and tokens stored on a public blockchain, are cosmetic or collectible items that live inside a game. These assets have become more than just in-game additions; they are cultural symbols and investment opportunities.

The global games market reached a staggering $182.7 billion in revenue in 2024 and is expected to surpass $188 billion in 2021. A significant portion of this revenue comes from in-game purchases, which accounted for approximately $54 billion in 2020 and are projected to reach $74.4 billion in 2025.

Brand partnerships with fashion labels and car companies provide fresh income and cultural prestige for studios, while early outfits in popular games like Fortnite have become cult symbols, with some being listed for sale on unsanctioned account markets.

However, the gaming asset market remains largely unregulated, leading to concerns about scams and fraud. Official markets for trading digital assets need strong identity checks and escrow protection to prevent such incidents. The European Commission's value-added tax rules may require individuals trading skins to be considered a 'taxable person,' and Europe's Digital Services Act and U.S. state privacy laws could tighten age-verification and data-sharing rules, increasing compliance costs.

Platform risk also exists, as items can plunge in value if a game loses popularity. For instance, the blockchain project Axie Infinity experienced a crash in 2022 after a token surge in 2021.

Despite these challenges, digital cards in sports franchises can upgrade based on team or athlete performance, and third-party trading of gaming assets, such as Counter-Strike skins and Roblox accessories, add significant volume to the industry. Scarcity, status, emotional attachment, and speculation are key reasons why people pay for digital gaming assets.

For investors, running a different due diligence checklist for digital asset-focused studios is crucial. Considerations include liquidity, custody, regulatory drift, and tax clarity. Dmitrii Khasanov, an angel investor, digital marketing expert, and founder of Arrow Stars, has invested in companies such as UiPath, Revolut, and Cazoo, and is actively involved in the gaming asset market.

Epic Games, the operator of Fortnite, prohibits the transfer or sale of accounts, skins, weapons, etc., and doing so can have consequences for players. Studios must balance fun and finance when pricing digital assets, with some players acting like analysts.

As the gaming asset market continues to grow and evolve, it's essential to navigate its murky waters with caution and a keen understanding of the risks and opportunities it presents. With increased regulation and a more informed investor base, this new frontier in entertainment and investment could offer exciting possibilities for the future.

Read also:

- Exploring Harry Potter's Lineage: Decoding the Enigma of His Half-Blood Ancestry

- Elon Musk Acquires 26,400 Megawatt Gas Turbines for Powering His AI Project, Overlooks Necessary Permits for Operation!

- U Power's strategic collaborator UNEX EV has inked a Letter of Intent with Didi Mobility to deploy UOTTA(TM) battery-swapping electric vehicles in Mexico.

- Global Gaming Company, LINEUP Games, Moves Into Extensive Global Web3 Multi-Platform Gaming Network